By James Bauersmith, JD, MS – Vice President, Translational Sciences

When you combine the UPMC infrastructure and support with the right mix of talent and perspectives of an entrepreneurial-driven team, you create the potential to make a broad impact on the health care ecosystem. To that end, we have assembled a team with diverse backgrounds and experiences that are able to apply their expertise to the work we do every day. This will be the first of many posts where you will get to read more about their experiences, interests, and the most pressing topics relating to health care innovation and the value of therapeutic innovation as it evolves in a dynamic landscape.

My personal background is nearly 20 years in the pharmaceutical industry; first as a patent lawyer doing Hatch-Waxman litigations (the legislative framework that facilitates generic competition to lower the cost of drugs for patients and payers while assuring economic incentives for innovators through market exclusivities and clear regulatory pathways) and then as a pharma executive in large pharma in various business roles running business development, portfolio, and corporate strategy. During my time as a pharma executive, I began to sense a change in tide concerning the public’s opinion towards pharmaceutical companies.

When I first started my career, pharma was a trusted purveyor of life-saving therapies, but as time went on some of that trust was eroded through a series of events related to business practices. As I examined these events and associated erosion of trust more closely, I saw that it tied back primarily to one topic: drug pricing… or in the words of the growing number of pharma skeptics, “price gouging” tactics, which continued to grow pharma revenue at a time when some saw the industry losing its innovative edge and focusing on sales expansion at all costs. It became clear to me that political and social winds were shifting around the pharma industry as it came under scrutiny for its pricing tactics – and Americans took notice.

I will never forget when in 2015, the Wall Street Journal published an article about Martin Shkreli and his company, Turing, revealing how the company had raised the price of the antiparasitic drug, Daraprin, from $13 to over $750/pill – a more than 5,000% price increase in a single day. That event became a turning point at a time of growing negative sentiment towards the pharma industry, and particularly specialty pharmaceutical companies, which often focused on less well-known drugs in smaller indications to disguise controversial business practices that could easily be construed as putting profits over patient needs.

Ultimately, Congress decided to investigate dozens of pharma companies and their pricing practices, including Pittsburgh’s own, Mylan (now Viatris). This 3+ year investigation by Congress resulted in a scathing report from the oversight committee on the problem of drug pricing in the U.S. as pricing outpaced inflation by 3x.

Still, drug spending has remained a relatively stable portion of health care spend (14% of total healthcare spend in the U.S.)[1], but pharma was nevertheless front and center in much of that report. However, like with most things, there are many nuances to understanding the key drivers of the issue and the stakeholders in the health care system that have a hand in drug pricing.

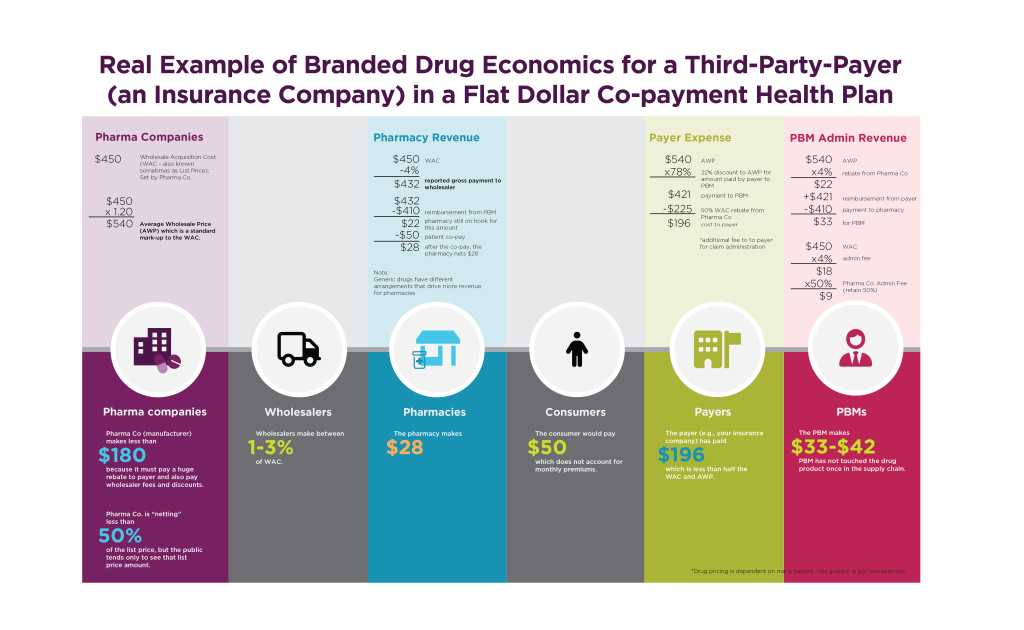

The number of players on the field and how they interact in a complicated ecosystem is one of the primary drivers of skepticism around drug pricing. The players include:

-

- Payers (e.g. insurance companies)

- Pharma Companies

- Pharmacy benefit managers (“PBMs”)

- Pharmacies

- Wholesalers

- Consumers (you)

Rather than walk through sorted nuances treatise-style, I thought it might be best to use an example of the money flow from start to end of the consumer purchase odyssey and how it impacts drug pricing:

Making this all the murkier: PBMs, pharmacies, and payers are often one in the same. Indeed, 77% of all prescription drug claims in the US are attributable to three entities: CVS Caremark, UnitedHealthcare’s OptumRx, and Cigna’s Express Scripts. These entities roll up to their parent organizations giving them large influence of the health care system. Congress, consumers, and new business models are all working to increase transparency for patients, and we closely monitor those developments at UPMC Enterprises.

Fortunately, at UPMC, we sit at the crossroads where innovation can drive the discovery of novel groundbreaking therapies that address the biggest unmet needs. Our decisions can be informed by the perspectives of our health plan to ensure our discoveries make economic sense. “We’re fortunate to have a close relationship with UPMC Enterprises.” said Chronis Manolis, Senior Vice President at UPMC. “UPMC Enterprises together with the UPMC Health Plan is uniquely placed to think about new ways to collaborate with industry partners in the pharmaceutical, device, and diagnostic industries to expand the practice of precision medicine to ensure patients receive the right therapeutic interventions at the right time.” UPMC is poised to do all of this while we move from a fee-for-service model to one focused on optimizing patient- and population-based outcomes.

At UPMC Enterprises, we are focusing our resources and experience to invest in and help develop therapeutic innovations that can drive disease modification and prevent expensive health care interventions with real-world clinical evidence. UPMC Enterprises facilitates groundbreaking therapeutic innovation across all stakeholders (pharma, payers, clinicians, distributors, and investors) to create a paradigm where all these stakeholders can succeed together and achieve the one common goal we all share: to drive the best possible patient outcomes while lowering health care costs in a transparent manner. Only together can we make this happen.

[1] A 2021 Report issued by IQVIA noted that drug spending represented only 14% of total healthcare spending between 1995-2021. https://www.iqvia.com/insights/the-iqvia-institute/reports/drug-expenditure-dynamics